ClaimKaro help you to ease the process by enabling faster settlement of your claims. You may have submitted your own insurance claim and now experiencing problems. This is not uncommon as insurance companies fight to retain their profits following a series of storms and floods. You may have a problem with either your insurance company or the loss adjusters that they appoint to look after their interests.

Whatever your insurance problem, we provide you with a professional service and attendance within hours where necessary so that we can explain policy cover and assist you prepare a detailed claim. We then meet the loss adjuster on site to ensure that there are the minimum of delays and subsequent misunderstanding over policy liability or quantum.

We are highly competent in insurance claim settlement domain with team having 5-20 years of experience and comprises of Advocates , Insurance professionals , Senior retired insurance officer & Insurance surveyors operating from Pune. We have records for resolving 20,000+ insurance claims

Anytime Claim Assistence

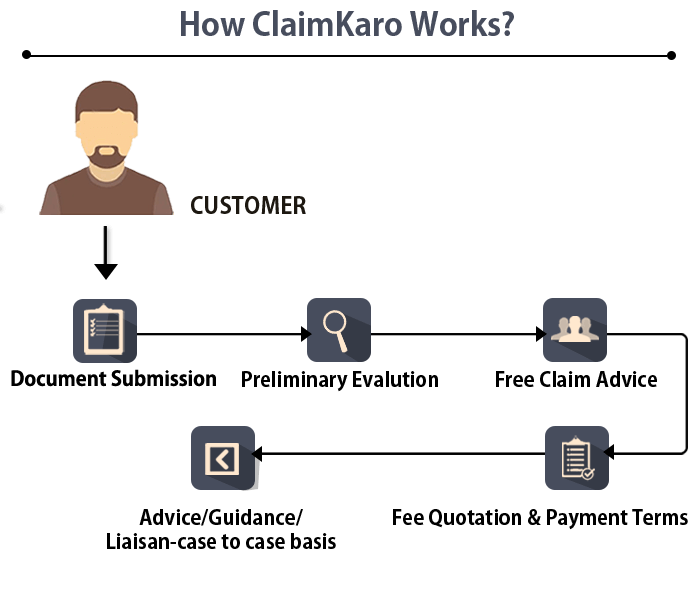

Process:

- Claim Representation – Compiling all important and relevant claim documents

- Claim Maximization Guidance – Claim to seek advice and further verification of documents to avail maximum claim benefits.

- Technical Discussion – We perform the Insurance Auditing, document verification to enable hassle-free claim settlement from both the ends.

- Onsite-Inspection – If required we tap the estimated loss by visiting on site.

- Submission – Submission of your claims

- Follow up – Get consistent updates from the insurer

- Contact IRDA Ombudsman/consumer court – It happens in case you face negligence or breach in obligation from Insurer’s side

- Goal Completion: Claim Settled

Advantage: Since we are involved from inception, it will ensure much favourable Surveyor reports.

Process:

- Claim representation – Document compilation

- Re-Inspection – Examining all process again

- Re-Submission – Submit Claim

- Grievance Handling- Sort out and clarify all

- Follow up – Get update on procedure from insurers

- Contact IRDA Ombudsman/consumer court – Incase of negligence or breach in obligation from Insurer’s side

- Claim Settled

- Claim Representation – Compiling all important and relevant claim documents

Process:

- Study the case: Examining all process. Finding reason for rejection/deduction.

- Suggestion: Give honest suggestions for re-claiming after careful verification

- Claim representation – Document compilation and submission

- Grievance Handling

- Contact IRDA Ombudsman/

- Consumer court – Incase of negligence or breach in obligation from Insurer’s side.

- Claim Settled